Trade forecasts April-July

Apple (20.09)

The deal of the year is officially closed +15% profit!

Previously wrote about a short position on $AAPL Last year it was exactly the same. This company was just unlucky that its presentation falls on September - the most falling month of the year. The probability of the forecast coming true was very high, for me this is one of the most likely deals of the year.

On Friday, 15% profit came, you shouldn't expect more from this company, it poses a threat further.

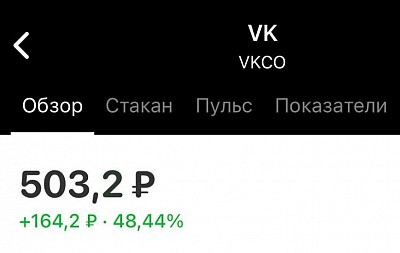

Vkontakte (15.05)

Vk soon 1,000r. We expect +100% profit.

The company is currently in a very good position in the market and has great potential.

Advantages :

- Growth in all directions

- Presence of 95% of Ru-net users

- Has virtually no competitors

We expect a significant rise and possible profit of 100% from the purchase of shares. I recommend closely monitoring the development of the situation.

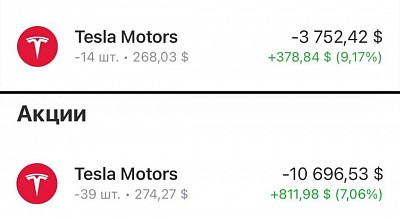

Tesla (02.09)

+$1,000 income per $TSLA

I heard so much that the market would grow in August-September and I would have to close the position at a loss, but time put everything in its place.

At the moment, the index is experiencing a technical rebound and may continue to rise by another 2-3%, but then, most likely, we may see negativity again.

Yandex (20.05)

The goal is set at 2,500 rubles, 3,000 rubles with further growth to 4,000 rubles.

Dear investors, I would like to share the opinion of the Globalfond team regarding Yandex shares. We believe that Yandex shares continue to demonstrate rapid growth and significantly outperform the market as a whole.

We note the growth of the IT sector and the increase in the flow of large funds in this direction.

We are confident that the first two goals can be achieved without any problems. Although we cannot guarantee rapid growth to the last goal, we are confident in the success of $YNDX in the market and recommend monitoring further changes in the company.

Tesla +130% (15.06)

I can confidently say that $TSLA will continue to grow and reach its target of $500 per share. We are convinced that the company will continue to build a strong position in the market due to its innovative technology and development strategy. I will note that I advised investors to buy their shares back in January, when the price was much lower, and now we see growth of 130%. Although some may not believe in the prospects of the company, we are confident in its success and will continue to follow its further development with interest. In addition, we see that the market is working out the 6th Wolfe wave, which adds confidence in the further growth of Tesla shares.

$dollar €euro (15.09)

The asset will soon take off!

For the last few months I have been actively buying $ and € (cash currency/foreign accounts).

•I buy $ because it will grow. You just have to be patient and have endurance.

•Buy € dollar index is close to its sunset before a good fall. Soon we can return to the ratio of 1.15$ for 1€. There are all the reasons for this - all sorts of convergences on high TFs, growing volumes on the euro and much more.

I have almost equal shares of euro/dollar in my currency basket, when the ratio is 1.15$ for 1€, I will start exchanging the European currency for the American one. During this time, the ₽ will fall in relation to them and the income will be simply excellent!

Dollar (25.08)

Currency $ and when will it go to 70-80r

Let's start with where it's going - we don't see any "interventions" from the state at the moment, import growth is developing in small steps, which cannot give a big jump in the exchange rate, but a strong ruble still hits the foundation of the Russian economy - the export of raw materials. Moreover, it doesn't matter if trade is not with Western countries, but with the same Asia - have you seen the Yuan exchange rate? And the Indian Rupee exchange rate? How much longer are companies ready to endure, while they only receive crumbs of bread, and do not bite off the whole thing?

I don't think so. Most likely, the state helps them, but this won't last forever either, everything comes to an end sooner or later.

Personally, I prefer dollars and euros, not Yuan, since it is only in numbers.

Targets for reduction and purchases are from the following levels:

1) 58p 2) 54-55p

I don’t particularly consider a reduction to 50 rubles, but I will be only glad if this happens, since no one will hold such a rate for long.

The first growth target is 68-70 rubles per dollar, I expect to see it by the end of the year - first quarter of 2023

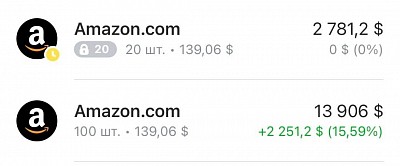

Amazon (29.07)

+$2,700 per hour with this company

Potential for another 35% upside.

Yesterday there was a report from a company like - $AMZN , which I bought during the first half of 2022 and as a result my position came out to a million rubles.

At the moment, I believe that in the near future we may encounter serious resistance and growth without a rollback is impossible.

We are at important levels, as is the market, so I will hold the position for the medium term, without aiming for quick money.

Goal - $185

OZON holdings PLC (27.07)

+72% in 1.5 months! Goal +130%

Anyone who has carefully read the posts and delved into them has long had a position on this company and is now reaping the harvest, because this is one of the fastest growing shares on the Russian market, which has even overtaken developers.

At this point I would advise you to reduce your position by 50% and set your stop at +30% so that you are in the black no matter what happens.

The company's target is 1,600 rubles and we will probably see it in the near future.

FIVE retail group (08.07)

+51% of the forecast for a month and +30% for two weeks!

We are talking about - $FIVE the probability of a shot is very high, because it wants to catch up with the growth of the magnet - now you can see everything for yourself!

Should I fix my position?

Definitely worth it! We don't trade without fixing. I'll say more - we set the stop at +15% so that in any case we have a profit.

USD/RUB (29.06)

Dollar 53₽. Are we going to 30-40? Will there be a reversal or will the green paper fly into the abyss.

1) I personally notice the growth of imported goods through parallel import. Most likely it will grow and in general, the recovery is going on, although not quickly (plus in the direction of the growth of the dollar)

2) The key rate continues to be reduced and they plan to do so further (weakening of the ruble - plus for the dollar)

3) The US is raising the rate (plus the growth of the dollar)

4) Oil will become cheaper and the minimum target is $75-80 (plus towards the dollar)

5) The imminent start of the 6th wave of Wolfe (plus towards the dollar)

6) The inability of exporters to compete in the market due to the low exchange rate (plus towards the dollar)

Simply put, if I am asked to find advantages in the direction of strengthening the ruble, it will be many times more difficult than in the direction of the USD.

If you remember the recent 15% surge in the dollar and you're not buying now, here's what needs to happen for you to do so.

In principle, I don't care who buys and who doesn't. I do this and I understand what awaits us in the near future.

PEAK

Flew into space! +20% in a week

Is there potential to grow further? Is it worth fixing?

Sometimes profitable ideas are in plain sight and usually obvious, but not everyone uses them.

Same as $PIKK . How many of you entered the trade and got that kind of profit?

Even after the announcement of the reduction of preferential mortgage rates, everyone could make a profit in the form of double-digit interest.

I will say more - even now this is possible if the position is held for more than 3 months.

Turn on notifications, don't miss out on opportunities.

Big Analysis (21.06)

Bitcoin 20,000$ - we go to 10k or return to 30k

You know, there is a phrase - "the eyes are the mirror of the soul". It can be interpreted to the stock market and bitcoin - "bitcoin is the mirror of the fund"

If a few years ago no one could have imagined that two different worlds would move along the same path and depend on each other, now this is the norm.

Possible Bitcoin movements and what they will depend on:

There are only two ways: 1) return to 30k with consolidation below this level 2) return to the old high of $12k and a smooth rebound.

The first option is quite possible if we see a decrease in inflation, a decrease in oil prices (they are essentially connected), positivity on the stock market (which will only be caused by a decrease in inflation) and important technical levels.

As we understand, the main factor is the stock market. Will it be able to turn around sharply and show growth to give Bitcoin the pace?

Unlikely. But the transition to a systematic return to previous levels may and the chance of this, even higher than 50%

But, there is also a risk of $12,000 per bitcoin and it is quite real. In what case?

If inflation does not stop and the increase in the key rate with the end of QE does not show results. In this case, the US and many other countries will face a recession and many other problems.

There is a chance of this and everything will be resolved in the next 3-6 months.

If you are a long-term holder of bitcoins - buy 30/40% now and the rest of the allocated amount for $12k and hold it for yourself for 5 years.

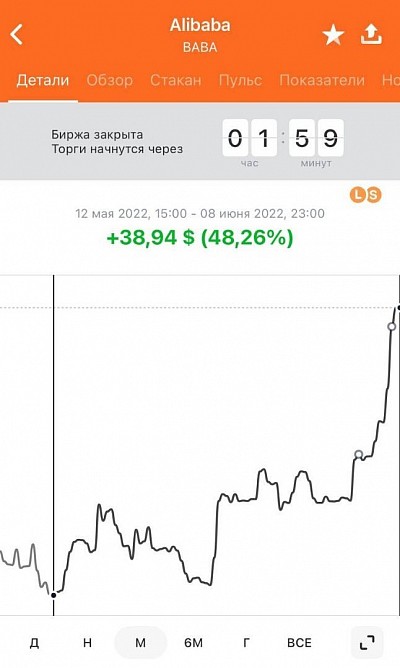

Alibaba (09.06)

+15% profit since yesterday. +50% profit in 1 month.

We are talking about - $BABA , which has been buried for the last year and a half, but I have been gaining a position and will continue to gain one until the price is above $200, since after this figure the company will be assessed objectively.

The short-term goal has been achieved in one day - we can record it. We are approaching the medium-term goal in small steps.

The news that the Chinese authorities may allow Alibaba's subsidiary to conduct an IPO (who remembers, the fall began with the ban and subsequent checks) could give a positive boost to the quotes.

Carnival (29.05)

30%+ profit in two days!

More than once, while many were afraid of a low dollar and the fall of the world currency, I bought dollars and used them to buy various companies.

One of the last purchases on the screenshots above - $CCL was purchased at a price of $11.86 per share, and a couple of hours before that I bought a dollar at 56 rubles

After 2 days $CCL is worth 13.4$, and the dollar is 67 rubles. But what does this mean for me and those of you who bought the dollar and companies?

Our final currency (mostly) is the ruble. When you need money, you need rubles. If the company has grown by 13% relative to the purchase price, then our ruble position is 30%+ and will continue to grow.

It feels like I turned on margin trading and entered with leverage, but no.

Ford Plunges 52%, Snap 85%, Crocs 74% (5/25)

What to do in the near future?

•$F is a weak company and has been for most of the time. Even at $17.50 I wrote to you - dump it and wait for $10 per share, maybe then it will be time to buy. There are few incentives for growth, the market is unfavorable - it is easier to forget about it and come back at $10.

$CROX, like Ford, is an incredibly weak company in the current state of affairs. I never shared the love for these expensive slates and I believe that even fewer people will buy them now, due to the worsening economy. The period of cheap money has come to an end - the period of growth of such companies too. (I wrote many times back when the price was $100, $70, that they will not last long)

•$SNAP is a company in which you and I have invested on numerous occasions and the last time we fixed a 50% position and I recommended setting a stop at +15% - which was undoubtedly a smart decision and exiting the position turned out to be favorable for us.

The disappointing report sent shares tumbling, and the answer to the question of when they will recover is "not soon." The company expects worsening performance in the future, which has almost never led to strong rebounds in the short term.

$ is now 56, a return of 80₽ is inevitable!

I am not one of those who thinks that the dollar will cost 30₽ and I hope that you are not one of those positivists either, because all the cards have been laid out long ago and from today we are seeing the first steps.

•Since May 24, the level of mandatory sale of foreign currency earnings has been reduced to 50% from 80%. According to the Ministry of Finance, this step is connected with the stabilization of the ruble exchange rate - even they don’t like it.

•The Ministry of Economic Development of the Russian Federation (a federal body) believes that by the end of the year the dollar will cost ~73.5 rubles, which is 31% higher than the current rate.

•The strong ruble was created exclusively artificially - by weakening imports and mandatory conversions for which there is no buyer.

I don't need to be a rocket scientist to understand a simple truth - lower the dollar to 50 rubles, 40 rubles, it will still cost 80 rubles.

I buy a buck at 56, the companies that have fallen on it or I leave it for myself to use.

The fall of the dollar is a blow to portfolios with foreign shares, but remember - this is temporary and when it returns to 80₽, you will have every right to write to everyone - "I told you so".

AMD (18.05)

22% profit in a week!

On April 27, there was a selection of companies that are ready to show good growth at the market reversal - now we are talking about $AMD

I think that you need to be careful and transfer part of the profit to cash, put a stop loss on the rest (breakeven) and wait for the target of $110 per share, where you can almost completely reduce the position.

The market is very uncertain right now and one should be careful.

In case of consolidation by 2/3 candles on the daily TF above $100 and DD (double bottom), we can count on the target of $128

Virgin Galactic (18.05)

Did Branson fool everyone?

•If you expect any company without profit to quickly return to its values - forget about it. The end of companies without profit has come. The monetary policy of the Federal Reserve is tightening, which puts pressure on such assets due to the growth of the key rate and the rise in the cost of their loans, on which they actually rest.

•$SPCE is no exception - the company is suffering from its supply chain, the general decline in the stock market, and a long period of modernization.

Any such company should be bought (if bought) only for the long term and for a small % of the deposit.

•When the stock market shows a reversal, when the Fed finishes tightening its policy or moves to a calmer and smoother tightening, then we will see growth in such assets.

BOEING, Spirit AeroSystems Holdings SP, Carnival (17.05)

These companies will show the post at 200% and more!

Some of the most promising assets in the current market are companies in the airline/cruise sector, which have been in correction for a very long time (since the beginning of 2020)

At the moment, a large number of companies have reached potentially important levels where we can continue to gain volume.

$BA, $CCL, $SPR - continue their return to wild-type revenue levels, while the easing of the coronavirus in the West and the summer period may contribute to faster growth (we just have to wait for China)

At the moment, the main negativity is due to the same reasons as in the entire market + the lockdown in China, but this is temporary and we all clearly see how the coronavirus is now receding into the background and new, more important problems are emerging.

Amazon (08.05)

I'm buying more $AMZN

The company remains promising over the next few years and that is why it is increasing its volume.

In addition, the dollar exchange rate is favorable for purchases.

There is chaos in the American market, which was to be expected at the end of February, and which has been discussed many times, but how long this will last and what will happen in six months, no one knows.

I only know one thing for sure - Amazon is a fairly strong company, which at the moment has had the strongest decline since 2008 (in 14 years) and in fact it did not deserve it.

I am ready to wait several years to get a good profit, if you are not ready - do not enter the market.

Amazon (29.04)

Increasing position to $12,000

I expect 100% growth from this company

Yesterday's earnings report by $AMZN didn't show what investors wanted, but I don't think the public reaction is a good indicator of a company's fate.

Technically, Amazon is at EMA 200 for the first time since 2008, close to oversold according to RSI and all this on a weekly chart and without much loss of volume.

Fundamentally, the company has not deteriorated, but has only slowed its growth, and not very much. Everything is logical here - the situation in the US with the key rate and the situation in the world are conducive to a slowdown in the development of many companies.

I increase my position in this company and now own 4 shares worth ~$12,000.

The final amount in the portfolio will be about 18-20 thousand dollars (the remaining money will go to additional purchases in case of a false breakout below EMA 200)

Tesla, AMD, NVIDIA (27.04)

America is Burning. Tesla Plunged 30%, AMD 48%, NVIDIA 46%

Is it time to gain ground?

Now we will go through each company separately:

•$TSLA has two levels of set: the current price and ~$720-730 on EMA 100, which will be a very strong support for the company

- It is better to collect in two parts: at current prices 30% of the desired volume, at EMA 100 another 50% and leave 20% in reserve.

•$AMD wrote back in the summer that it was time for it to go below $100, but it kept resisting, the time has come, so to speak.

Two levels of recruitment: current prices and at EMA 200 ~75$

-The first set is 40% of the allocated amount for the company, the second is also 40% and 20% in reserve.

•$NVDA was bought a year ago, when it was also predicted to fall, and in the end it gave us 100% profit. Then everyone expected growth, and we did the opposite, and here is where the company is now.

You can collect in two parts: from current ones by 30% of the volume and from EMA 200 by 50% of the volume, and 20% in reserve.

All three companies are quite interesting and can show good results in the medium and even short term.

Microsoft & Google (27.04)

$MSFT and $GOOG

These assets were acquired for the long term, since my goal for the next 1-2 years is to acquire as many good companies as possible at attractive prices.

I will start them if we go closer to EMA 200 for each of the assets.

Both companies, in my opinion, are worthy of being in the portfolio for an adequate amount:

•have an excellent growth trend and potential for further development

•good performance

•close to strong rebound levels

There are many advantages, but there are also disadvantages, which is why we keep money for high-quality averaging in the event of further market correction or unsuccessful reports.

Apple, Tesla (12.05)

Apple will cost $100, and Tesla $500. Urgent analysis of the companies.

Some of the most popular assets on the American market have all the signs of rolling back before a rapid rise.

•Apple - up 200%+ since 2020 while revenue is up only 50% (even old Buffett was trimming his huge position.)

But the most interesting thing is that it is not flying down, along with the rest of FAANGM and has not even touched its EMA 100, while Amazon is already testing the 200th

•The rising key rate, the Chinese situation and the special operation may affect the sale of equipment for the worse

•Objective value of the company ~ 100-105$

•Tesla - up 1,800% since 2020 bottom. Up 700% since January 2020

Its revenue has increased by 150% during this time, which does not correlate with the stock price at all.

•China's auto market is the world's largest and the country's situation could hurt auto sales

•Objective value of the company - $500

I think both companies are great and will grow in the long run. Apple at $500 and Tesla at $3,000 are not a stratospheric future, so I will add them to my portfolio at important points.