Trade forecasts february

Content creation and design platforms:

Writesonic | Copy.ai | Copilot | Rytr | Simplified | Contentbot | Peppercontent | Jasper | Inkscape | Sassbook

Platforms for working with artificial intelligence and programming:

IQBid Nolan AI | ChatGPT for Google | MyGPT | ReadTrellis | Jenni AI Poe | OpenAI GPT-4 | OpenAI ChatGPT | NotionAI | MathGPT | Type AI | ExplainLikeImFive AI | Pet Name | Boomy | GPTales

Text to speech platforms:

Voicemaker ReadSpeaker | Host Voice API | Text to Speech Robot | Natural Readers | Text to Speech | Zvukogram | Amazon Polly | Google Cloud Text-to-Speech | IBM Watson Text to Speech | Uberduck

Additional resources:

Dollar above 100 rubles (1.03)

What should you do in such a situation?

Throughout 2021, I wrote to you - buy currency, keep a basket of at least 3 currencies. Those who followed this rule are now harvesting, those who did not listen are panicking, and it is understandable, because there is no certainty in the future of the ruble at the moment.

The key question on the agenda is whether it is worth rushing and collecting the dollar at 100 and above?

If you had volume before this and you thus average the average price to 85 (conditionally) and your risk management allows you to do this - why not?

If you haven't had dollars before, there's no need to rush. Look at and analyze 2008, 2014, 2018, 2020. Everywhere you'll see a good pullback after a sharp rise, where one of the best entry points will be.

Personally, I hold currency and have been accumulating it for a year. I did not count on such an outcome of events, so I will also be accumulating it at the moment of positivity, even if it is imaginary.

This situation will serve as a lesson to us all, some dear, some almost free.

Tesla has reached the right level perfectly.

16% profit in one day!

A little over a week ago there was a post about $TSLA , where I indicated a strong reversal level (the same was in March 2020) - 100 EMA

Actually, the price stopped at this level yesterday, thought about it and turned around. Until 17:00 St. Petersburg the exchange was closed, so I take the profit from the moment of opening, although in fact it is ~ 19%

Further movement will largely depend on political factors and the Fed. You can fix speculative profit or hold the position in the medium term with a stop in B/U - as you wish.

The Russian market has sunk into the abyss .

The situation is stalemate - what is the best course of action in such a difficult time for everyone.

Russian market : in connection with such an incredibly terrible scenario, it is better not to get involved here. I always told you - do not hold more than a few percent in Russian stocks. I hope that many listened then. There is nothing more to say here. No levels will help, only the end of military actions (and even that will not affect immediately)

American market : in this case, no fundamental factors, rather a simple panic. They can pour as much as they want, but answer yourself the question - have Amazon, Apple, Google, Salesforce, Carnival and other stocks changed fundamentally? No, they were strong companies, and they remain so.

My portfolio is 85% American for the long term, I am sticking to my plan and will continue to do so.

Tinkoff collapsed by 50% (02/24/22)

Will the company be able to recover?

You can buy this company only from 4,000 rubles and not more. The company's extreme zone of strait without taking into account possible sanctions (unlikely) is 3,300 rubles per share.

$TCSG itself is an interesting paper for a medium-term portfolio or for speculation, as it has strong volatility.

When positive things come to the Russian market, Tinkoff will be quickly bought out.

The main advice is that due to the geopolitical situation in the country, you should not take more than 1% of the deposit.

Entering Alibaba with $2,000 (20.02)

When will the growth start? Will it start at all? Is it worth buying China?

After restructuring my portfolio of Chinese companies, I left a few and $BABA is a forward of this market.

Naturally, the company is undervalued and greatly so, but this cannot serve as a factor for growth.

Throughout 2021, there were tense relations between China and the United States, now the vector is shifting towards Russia, and China has realized that its own companies need to be helped, not worsened.

This purchase is aimed exclusively at the medium term and my first price target is $250.

Addition - do not keep China for a large percentage of the deposit, the assets are risky.

Dollar 80. S&P 500 returned to the bottom (22.02)

The market collapsed.

Discussing politics is the last thing to do, the most important thing is what to do in the current situation?

Regarding the Russian market - at the moment it looks quite attractive, but only if you take a position with at least a range of several years. There are sanctions ahead, what they will be - only Biden knows, but I believe that the market has partially taken this into account in the price of assets. It is quite adequate if you keep 3-5% of the deposit in Russia (Yandex, Sber, Tinkoff)

As for America - if we look at a similar situation in 2014 (the annexation of Crimea), we will not see a market fall at all. Such a reaction is rather caused by panic, because with each new month 2022 only adds problems and puts more pressure on the market. Personally, I stick to my plan - buying fundamental companies from my EMA 100/200 on the weekly TF.

Remember the main thing - don't go in with all your might, take into account the risks of continued escalation of the conflict, as well as the actions of the Federal Reserve.

Apple will fall by 20-30%

Don't rush, soon you'll be able to buy cheaper!

One of the few stocks that did not suffer a significant correction at the beginning of this year and the end of last year.

Personally, I will only buy $AAPL from the 100/200 EMA levels

There is no clear reason to believe that tomorrow or in a week we will see a price of $130-140, since the latest report is pulling the shares up/not letting them fall, but such a prospect will appear in the foreseeable future.

In general, if we look at the chart, every 4-5 years Apple experiences a “recession-recession”, which is accompanied by a clear touch of the 200 EMA and strong oversold (the last one was in 2018)

The company is amazing, but there is a limit to everything and now the price is high. It can go even higher, but in the end we will get much more pleasant prices.

16.02

Virgin Galactic has grown by 40% in 1 day.

Is this the beginning of a reversal? Time to enter a position?

I still hold $SPCE and yesterday it grew by ~$1200, but overall it is still in the red

The flight happened on the news about the opening of ticket sales from February 16. The news is really good, especially considering the report on the 22nd, the expectations of which clearly did not include this factor.

But the main question is: is it worth running out and buying shares?

The answer is - only if you are a medium/long-term investor, since flights will only start at the end of this year and how successfully (and whether they will start at all) is still unknown.

As I have already expressed in posts before - Virgin Galactic is not so good for speculations anymore, because there are fewer reasons for them. Therefore, if you are not ready to wait - do not play in the casino.

15.02

Oil has risen by 500% in 2 years!

Is it time to drop to $50 and short?

You know, I think oil has its own prospects, even with the development of alternative energy, but now the price per barrel is too high and definitely needs to cool down.

If we look at the chart, we will see that at the moment we are at very strong resistance and in a downward channel since 2009.

One of the growth factors is geopolitical tension. I think at least half of what we see is fake and simply inflated out of thin air.

An adequate price for oil is around $50. It is unlikely that we will quickly reach such a figure by direct nosediving, but this is a very realistic mark.

Is it worth going short? It's up to you, because oil = medium-term position. Personally, I will wait for adequate prices for $PBF, $XOM and many other companies, which were the same in the summer of 2021, when we actually bought them.

14.02.2022

Tesla has fallen by 31%. Is it going to $500? When to gain positions? Or will there be no reversal?

We are currently in a market-wide correction, where $TSLA is doing just as well as the rest, posting a great report. Yes, they recalled a lot of cars, but they did the same a year ago, which is not shocking.

The maximum Tesla rollback in my opinion could be around $700 to 100 EMA. The probability of going to 200 EMA is too low, since something fundamental should happen or a strong correction of ~25-30% should begin for S&P 500 (also unlikely)

At the moment we are at EMA 200 on the daily chart, which is also a buy zone for a rebound. The risk is high and if you gain - very little.

The conclusion is simple - we wait for important levels and buy calmly, so that when the market turns we will get a good profit.

10.02

We are preparing +13% per day and +25% in a couple of weeks

Growth potential from 300% to 700%, don't miss out!

$DIS, whose history began almost 100 years ago, reported once again and showed excellent results.

Since November I have set the price for additional purchase of the position at $129.

A good strategy would be to buy in two stages: 1) at current prices 2) at $120-130 in the selection zone.

The company has had a long upward trend since the 80s of the 20th century. It spends huge amounts of money on the production of its products, and we are not only talking about films and cartoons, but also about other entertainment - for example, parks.

At the moment, due to restrictions, there is no profit in many businesses, but it will quickly recover within a few years.

This company creates irreplaceable products that have no worthy competitors, which is why it is the best in the world.

Now it is being squeezed into a triangle and most likely we will go for a breakout through support, so I advise taking it in two parts.

The company has huge potential. Clear prospects that will open up in the coming years and a huge audience that has known this company since childhood.

If you have enough strength, time and desire, then in the long term (not a year or two) you will probably see a 300-500-700% plus on the position.

03.02.22

FaceBook fell by 23% in an hour!!! Should I sell or build up my positions?

What and how am I doing at the moment and what awaits the company in the future?

$FB reached its EMA 200

Last night, having analyzed the market reactions to all the negative reports of the company, starting from 2017, I will say the following - it fell by 15-20% each time and easily showed new highs within a few months-years. If you read somewhere - $FB fell so much for the first time, then the person takes the information from his head.

Based on TA and investor sentiment, I dare to assume that we can break through EMA 200 by 5-10%, but this is short-term (this was the case in 2018)

The company is great in terms of FA, I don't see any reason not to gradually increase the volume. I entered another $1,500 and have $1.5-3k in reserve.

I believe the company is undervalued at the moment and in the medium and long term investors will see good numbers on profitability. One or two reports do not decide the fate of a giant, remember that.

11.02

Astra Space collapsed by 45% in an hour.

Is the company a dummy or is it worth investing in?

Its main idea is the “Rocket” launch vehicle, which should become one of the cheapest and easiest to operate in the world. Which will allow for “modest” money to deliver 150 kg of cargo to low Earth orbit.

Am I investing? Definitely not. I don't play casino. Out of 8 flights they had 1 successful one. Yesterday's reaction of investors to the failure showed how tired they are of waiting for that success in space.

I think the company is hopeless. And I can invest in it, but only when it shows results.

Why should I give my money to those who cannot fulfill their obligations and deliver the cargo?

Such stocks have high risk. Tomorrow it can cost both $10 and $1, while it has nothing fundamental that will define it - this is a casino.

Should I invest now? No. Will it be possible to invest with +- constant success and establishing flights? Yes.

O8.02 hanging of the key rate!

Market on the brink. Inflation in space. Fed schedules closed meeting. Will the rate be raised next Monday? Urgent analysis.

Yesterday, the inflation data in the US came out and it was significantly worse than expected. Many were surprised, but the question is - why? No one raised the rate so that inflation would not grow, why shouldn't it be higher than expected?

The investors were most excited by the Fed meeting scheduled for the 14th. Many think that the key rate will be raised there and this will be a complete surprise for the markets. I will say the following - the market has already accepted the rate increase at least 5 or 7 times this year and even a 0.5% increase will not be some kind of incredible sensation. If it happens next Monday - please, but I have doubts about it, since there is no point in such a rush when everything was scheduled for March

This year will not be an easy one, but that is why I recommend you keep some cash so that in case of force majeure you can buy good companies at ridiculous prices!

I don't care about the key rate at all. Let them raise it and fight inflation, I will gladly buy fundamental companies from my important levels (100/200 EMA on the weekly TF) with increased volatility.

I still think that 2022 is a gift, not Armageddon, because many regret not being on the market in 2016, 2018 and even 2020, when everything was much cheaper. So accept 2022, what's worse?)

Thank you for your attention, this is not an investment recommendation.

05.02.22

Amazon gave 15% in 10 minutes and brought $850

Increased the position by 2 times! I am telling you about my plans for the company!

Yesterday evening I doubled my position and now my portfolio contains 2 shares worth $6,500.

The company has shown explosive growth due to a good report, but I have not fixed the position and do not plan to do so in the near future. I will say more - even in the coming years.

My goal is to increase it in the long term and have from $12,000 to $15,000. Each time buying from clear levels of 100/200 EMA

At the moment, I do not expect a strong upward trend, although Amazon is predisposed to it. This is due to the mood of the markets for the next six months, but the position will be built up in difficult times for everyone.

07.02

I expect Bitcoin to be around $80,000 by the end of the year

Bitcoin follows the stock market, so the moment of correction for it will also come with the increase in the key rate. I believe that the cryptocurrency is not at the peak of its popularity, there should be another strong impulse, which will be the last before a serious collapse of everything. Therefore, contrary to others, I will expect Bitcoin ~80k$ by the end of the year. While everyone is waiting for a fall - there will be growth, this is already true.

Today I found the bottom perfectly. Excellent work. 30% growth in a couple of weeks, but first we identified the fall!

There I also indicated the main support and a strong figure on the weekly TF (head and shoulders), which hinted at a continuation of the correction.

As a result, we rolled back 25% exactly to the zone and bounced back from it by 30%

We are now approaching an important level at $44,500. If you hold positions in Bitcoin or crypto companies, set clear stops.

04.02.22

Why Virgin Galactic Fell Like a Stone and Why I Still Hold My Position

Many believe that Branson's brainchild is doomed to failure, because it has reached its global bottom. The reasons that are usually heard have their truth - the company has problems: issuing bonds to attract new funds, the risk of additional emission for the same purpose, difficulties in launches, constant flight postponements and much more. But - such problems haunt almost every new company.

I have not sold my position and do not intend to do so. I am not a fan of space tourism, but I am sober-minded. The company's fall was caused by less fundamental factors than a simple panic sale, similar to other weak companies without fundamental support.

The space tourism market is estimated to be worth $120 billion. If Branson gets his way, we could see growth of over 1,000% within a few years, but there is a lot of risk involved, as there is with any potentially high-yield asset.

My position does not "suffocate" me, I did not enter half of the depository and not even 10%. Such assets can be in your portfolio only taking into account risk management and understanding of the transaction. Holding 1-2% of the depository, as for me, is quite adequate if you do this with long-term goals.

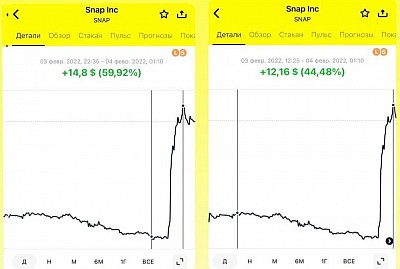

04.02

$SNAP +60% profit in an hour after the report and +44% on our position. Fix or hold?

Contrary to popular expectations, $SNAP delivered a stellar report that sent its shares soaring.

It is worth taking the company from the $28 level.

The main rule in trading is that the crowd is wrong 90% of the time.

What do we do now? +44% is a decent result.

In the medium term, I expect to see much higher figures, but it is definitely worth closing the position speculatively. If you hold for a long term, then close 50% of the position, leave the rest with a stop at 20% of the profit.

24.01 - 30.01 Exchange

This time the key purchases were companies that had reached their important zones or were extremely undervalued for a stupid reason (in my opinion, for example - Netflix)

Trades: $AMZN , $FB , $ADBE , $NFLX , $CRM , $BA

Plans: to double the share of Amazon, Adobe, Salesforce

Netflix, Meta and Boeing's share triples

While everyone is expecting a terrible year, I am not particularly pessimistic about it, I also expect 5100-5200 for the S&P 500 by the end of 2022

The companies are mostly taken on for the long term, since each one has hundreds of percent potential.